Budget Brainiacs B2C Campaign Sample

A small amount of my freelance copywriting skills are due to a lifelong love of writing... and I learned the rest through copywriting courses.

Here, you'll find a campaign I wrote for a course assignment.

The client is the fictional company Budget Brainiacs, a web-based program and club for families with children ages 10 and up.

Its mission is to be a destination site kids look forward to visiting while they learn critical financial skills and earn rewards. Parents help their children log on to their personal game page, then the kids go through a series of games etc to learn how money matters work.

My assignment was a five-part B2C campaign sample containing:

This is a relatively small campaign, and definitely something I could create for your business.

Blog Post

A Banker Mom’s 3 Easy Steps For Raising Money-Smart Kids

I met my dear friend Susan for lunch this week. You undoubtedly have a "Susan" in your life: She somehow plans every meal, keeps a gorgeous home, wins the adoration and respect of her children and partner... and looks perfectly put-together while doing it.

We chatted about the usual subjects: holiday plans, recipes our kids absolutely loved (or hated!), and finances.

Susan is especially on-the-ball about money and budgeting. So, the news she shared about her 12-year-old, Olivia, left me speechless.

It wasn't about Olivia’s awesome grades... or her budding interest in boys (phew!).

It turns out Olivia opened an Etsy store… but Susan only found out because Olivia asked for bank account info to deposit sales money!

Unfortunately, Susan is very reluctant to discuss money with her kids. As a result, Olivia had been selling these trinkets for quite a loss compared to the allowance spent on supplies.

Olivia made $147 in sales but spent $255 on supplies and shipping materials (many months of allowance!).

Olivia thought she was making money, and that Susan would be delighted about Olivia's "income."

Instead, Susan has been trying to educate Olivia on revenue/expenses, tracking income, and living within your means…

…but the damage has already been done.

Olivia is now despondent and uninterested in making money or even learning basic, necessary money habits…. Habits she’ll need to survive as an adult in the real world.

I have my MBA in Finance, so Susan asked for my top tips on raising money-smart children... without losing their interest.

By the time lunch was over, I realized all parents should know my 3 easy steps for raising money-smart kids… especially since my children had so much fun learning real-world financial literacy!

Imagine: The kids are home from school, done with homework, and complaining of boredom. Instead of another hour of Disney TV, you follow 3 easy steps.

Each step organically flows to the next. You have your children’s undivided attention…. And there’s no crying or hitting.

Just you spending time with your beautiful children, and everyone is laughing and smiling. What parent wouldn’t be excited about that?

Here Are My 3 Foolproof Steps To Raising Money-Smart Kids

1. Get hands-on with money now. Show your children how to tell different coins and banknotes apart. Next, create an allowance system and get a “see-thru” piggy bank.

Now they hear, see, and feel their savings accumulating!

Next, allow your children to buy treats… whether the bank is full or not. They’ll learn that an almost empty bank means small treats, and a full bank means big treats.

2. Set an exciting money goal together. Now your kids understand the value of money and what they can do with it.

Ask your kids to write a “want list”, and a cut-off date for getting each item. They may want a kids’ camera before a big vacation, or a video game on its release date. This direct visualization is a great motivator for kids of all ages.

3. Budget as a family. Step 2 eases kids into the idea of tracking money for something they want. Next comes the real nuts and bolts.

Do your budget with your children weekly. Explain that you’re writing down everything you spent that week for two reasons: First, to find out how far you are from your money goals. Second, to make sure costs don’t outweigh your income.

Have them do the same: record everything they spent on that week and compare to their allowance. If they’re “in the red,” help them prioritize wants vs. needs.

Just as you know fixing a broken appliance may require delaying your Caribbean cruise, your kids will learn that picking a toy during every store visit means they can’t get their video game on the release date.

These 3 steps quickly cement the idea that spending money means weighing pros/cons and making choices.

…And that’s it! It really is as easy as “1-2-3: Get, Set, and Budget!” I used these same 3 steps for my own children, who are now teenagers with jobs and clear understandings of how to achieve financial security.

I also run a workshop for children at my bank using these 3 steps. I’ve yet to meet a child who isn’t excited about money & finance afterwards!

That said, our kids know us. They know when we’re uncomfortable or reluctant. If your children don’t jump for joy during this process, don’t be discouraged!

It takes time—for parents and kids alike—to get comfortable discussing “grown-up” topics together. Perseverance is key.

Schools Won’t Teach Kids To Be Money-Smart… But You Can

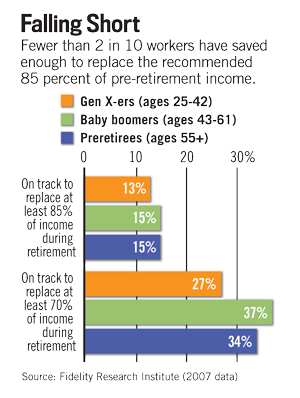

According to a 2015 study by FINRA (The Financial Industry Regulatory Authority), we parents must teach our children financial skills before they start college or enter the workforce.

And yet… Today, only HALF of U.S. states mandate any kind of financial education before graduating high school. That’s right, only 25.

The schools can’t wave a magic wand. There is no POOF! moment where your child suddenly understands finance and money habits.

It’s up to us, as parents, to be the last line of defense and equip our kids for the real world… even if the first conversation feels a bit “awkward.”

So, next time you hear that classic refrain: “I’m boooooored!” Just take a deep breath and dive into Step 1 with your children. If I can teach this to my children—and children of complete strangers—anyone can do it!

Editor's note: What parent would say “No, thanks” to even MORE professional help raising money-smart kids?

Imagine a finance pro and fellow mom helping you with:

- Introducing concepts of money and finance to your children in a fun and exciting way

- Reinforcing key financial concepts for children of all ages

- Answering kids' 7 most common (and brutally blunt) money questions

- ...And custom-tailoring activities for YOUR children once you've worked through these steps!

Click here for all the details.

Google Ad / PPC Ad

Landing Page

Discover 9 Fresh and Fun Activities for Raising Money-Smart Kids!

Budget Brainiacs publishes the only financial activity guides endorsed by VISA… Aimee Greczmiel, mother and VP of TIAA Bank… and happy tweens… worldwide!

Are you—like any good mother—worried schools aren’t equipping your kids to thrive… let alone survive… in the REAL WORLD?

Our brand-new FREE guide will put your worries to bed!

Imagine: Instead of hours of useless “screen time,” you’re spending time with your beautiful children… everyone is smiling… while learning real-world financial skills…

And YOU, Super-Mom, Made It All Happen… With 1 Click!

- 9 activities designed by finance pros, approved by real tweens… so you know your kids are learning insider secrets while having genuine fun.

- No one gets left out… because all activities work with any number of children.

- Digital download… so from road trips… to rainy afternoons… to snow days… you always have an educational, boredom-busting secret weapon.

Eventually, you’ll need to teach your kids about money in the real world. Most of our guides are priced from $19 to $59 depending on length and content.

But you won’t pay a cent if you act fast… AND you’ll have a perfect example of being money-smart for your kids.

Plus, download now and receive a FREE bonus guide chock-full of professional tips on how to custom-tailor even MORE fun money activities for your family!

Enter your first name and email address below. We’ll instantly deliver your TWO FREE Guides for raising money-smart kids!

First name: _________________

Email address: ________________

Yes, my family deserves to have a blast while learning smart money habits!

Subject Line: Fun Finance Games Inside! Open Today for $373 of Free Gifts!

Hello FirstName!

My name is Angela Jenkins…

I’m the Creative Director of Budget Brainiacs and Author of your new guide, 9 Fresh and Fun Activities for Raising Money-Smart Kids.

Your Guide is attached. Thank you for downloading!

Inside, you’ll learn what the activities entail, how to get your child engaged in the material, and you’ll even get resources to customize fun money activities for your kids.

But this is just the beginning…

You see, there’s another brand-new way to get your child asking, “Just 5 more minutes?” while learning real-world finance.

And we’re so proud of it, we’re giving you $373 worth of bonuses… even if you don’t spend a dime.

You won’t always be by your child’s side… eventually, they’ll need to know how to be a “money-smart” adult without calling you.

That’s why I’m so excited about Budget Brainiacs. Founded and designed by a fellow mom with her MBA, Budget Brainiacs will help you and your kids!

We’ve made sure our program is chock-full of can’t-be-found-anywhere-else benefits:

- Activities designed by finance pros and approved by tweens… so your kids learn real-world money smarts while having a blast.

- Completing real-life lessons earns points your kids use for real prizes… so they hold the fruits of their labor in their hands.

- Endorsed by mommy blogger Harriett Walters… who says her & her 30k readers’ kids are “buzzing” about our “home run” of a program!

Ready to start your kids on their path to retirement savings and lifelong financial freedom?

Great!

Because the very first lesson shows your kids how much fun it is to start saving.

And the program is a digital “board game” they play to ensure each lesson connects to the next.

Click here for all the details… and to choose your 2 FREE Bonus Gifts.

I can’t wait to support your family through this journey!

Rooting for you,

Angela Jenkins

Creative Director, Budget Brainiacs

Author, 9 Fresh and Fun Activities for Raising Money-Smart Kids

P.S. Budget Brainiacs is always backed by a 100% iron-clad money-back guarantee. If our program isn’t a good fit for any reason… or no reason at all… just let us know within 90 days of your purchase.

You’ll receive a full refund AND you’ll keep your FREE Bonus Gifts as a “Thank You” for trying us out. ($373 value!)

Yes, I want no-risk “Keys to the Kingdom” for my kids’ financial future!Sales Letter

The True-Life Story of an Over-Worked Mom Stressing About Her Children’s Financial Future… Who Stumbled Onto the “Keys to the Kingdom” of Financial Security for Her Children

Dear Fellow Mom,

Hi, I’m Angela Jenkins. These are my 11-year-old twins sharing our tablet…

I know that’s a strange introduction!

I’m not showing you my tweens like this because I’m selling tablets…

I’m sharing this photo to make an important point about our every-day routine.

And the set-it-and-forget-it routine YOUR family could enjoy very soon.

My kids want “screen time” before and after school… and, yes, during long car rides.

But, unlike last year, my kids aren’t “zombies.” No, my kids spend their time learning real-world finance…

…while laughing and smiling. They even happily share without my reminders to “Play nice!”

It Wasn’t Always Easy

But I have a confession…

It wasn’t always easy. Each day was a war in our home. Because every day, I tried drill sergeant techniques with my kids… without success.

Goodness, I cried every night about being a “mean mom” whose kids didn’t listen…

But what else could I do?

I didn’t know how wrong I was.

Because now, my kids love sharing together.

Arguments ending in tears, leaving everyone emotionally raw? GONE!

Best of all, they’re forming habits guaranteed to help save for retirement, avoid debt, and enjoy lifelong financial security.

So What Changed?

How’d we go from feuding to happy family?

I’ll share soon. First, let me ask YOU…

- Are your kids always bickering?

- When your kids are home, do you despair… because you’re facing another whirlwind day of yelling?

- Do you spend more than an hour a day worried about what’ll happen once they leave the nest?

Or maybe…

You just wish someone knew exactly what to say and how to say it… so YOUR kids could learn real-world skills, have fun, and strengthen sibling bonds.

Sound familiar?

If so, keep reading. Something changed our lives… I believe it’ll change yours too.

An Email Changed Everything

It began with an email I received from a mom named Jenny Sanders.

Jenny and her mommy group searched for real-world info kids need to survive. She wrote about Budget Brainiacs… a program designed to teach tweens information while being fun and captivating.

Information they need to succeed, but schools won’t teach:

- Determining if an apartment is affordable

- Avoiding the trap of high-interest credit cards

- Secret formula ensuring they’ll save plenty for retirement

- …and so much more!

She’d tried many other programs claiming to do this, but her children found them too “childish” and “cartoon-y”.

Like Magic: Learning, Sharing, Laughing!

But almost overnight, Jenny saw positive changes. Her kids were getting along with each other, discussing money with friends, and less interested in watching TV.

On top of that, Jenny said other moms in her group had similar results. And none of them studied child psychology or education.

Sound too good to be true?

I thought so, too!

My instinct was to delete the email like I do with all “junk”.

But I couldn’t forget Jenny and her family. I re-read her email, day after day.

The cost really wasn’t much. But I’d already tried many classes and camps, just for my kids to declare “That’s for babies!”

I finally opened the website, asked my kids to play the free demo games, and crossed my fingers.

When they finished, I didn’t even have time to ask their opinions.

“Can We Play More Together?”

“Mom, can we play the next game?” they begged. “Can we play more together?”

We subscribed that very night…

It’s a purchase I’ll never regret!

Because the moment I clicked “Confirm” we had the “keys to the kingdom” of fun, on-demand finance education.

My kids picked up right where the demos ended… and haven’t stopped since.

Your Family Deserves It

I felt I hadn’t “earned” such a simple, all-encompassing solution. I even had friends saying it was a “scam” and couldn’t possibly be so easy.

But the proof was in the pudding… and in my kids’ blissful laughs.

So, I asked myself… Why not?

I might ask you the same…

- Why shouldn’t your kids have fun learning at their own pace?

- Why shouldn’t your kids have every fighting chance to succeed in the cruel real world?

- Why shouldn’t your kids earn prizes for their hard work?

Most of all…

- WHY SHOULDN’T YOUR FAMILY START TODAY?

Start Now! (But Take 3 Months To Decide)

I want even the harshest skeptic to try it. Competitors charge $10 per lesson. ($300 monthly for daily lessons!)

I’ve dropped dues to only $29 a month… Just 94 cents a day. And your kids get unlimited access.

So please don’t wait. Click this link now:

Join Today!

But take 90 days to make your final decision. After THREE FULL MONTHS of daily games, lessons, and prizes, if your kids…

Are NOT learning real-world finance habits…

Are NOT having a blast earning prizes for learning…

If you aren’t COMPLETELY CONVINCED it’s their key to lifelong financial freedom…

Let me know. You’ll receive a FULL REFUND… and you won’t have to explain anything to me.

Totally risk-free, right?

Then click below now…

Join Today!

Sincerely,

Angela Jenkins

P.S. During this limited-time invitation, you’ll get 2 bonus gifts… absolutely FREE. ($373 value!)

FREE Bonus Gift #1: Welcome prizes! ($25 value!) Two prizes for each child’s account:

- Brainiac Backpack

- Brainiac Wallet

- Brainiac Ballcap

- Brainiac Pocket Calculator

FREE Bonus Gift #2: Matching subscription! I’m so sure your kids will love Budget Brainiacs, I’m investing in them.

- Buy 1 month today… you get 1 month FREE.

- Buy 12 months today… you get 12 months FREE!

But this offer is only available to first-time subscribers... and may never be repeated.

Think about it… 50% OFF your purchase! Buying 12 months saves you $348…

…and everything falls under the iron-clad money-back guarantee.

Best of all, the Bonus Gifts are yours FREE – even if you get refunded!

To join Budget Brainiacs … and get your FREE Bonus Gifts worth $373 (more than you’re paying to join!) … click below now:

Get the “Keys to the Kingdom” for your child’s financial future now!B2C Campaign Sample: Results

This mini-campaign received high marks all around. From the content of each piece to how quickly I made requested revisions, my instructors applauded my work and professionalism.

Here's what the client said about the copy:

"Very beautifully written blog. Excellent work! The ad... is easy to read and light-hearted about a heavy topic. Great job making it sound easy!

Good job in making the [landing page] copy succinct and above the fold. The design makes it scannable... Great CTA! Nice work!

[The email is] another well written piece! Well done!

You've done a fantastic job... and understanding how to apply [the requested campaign revisions] indicates a great copywriter."

Are you ready to discuss your next B2C campaign?

Could your company benefit from a well-written campaign to funnel in new prospects? Contact me today to discuss your next project.

Looking forward to speaking with you,

Shelby Dennis

Your Freelance Beauty Content Writer and B2B Copywriter